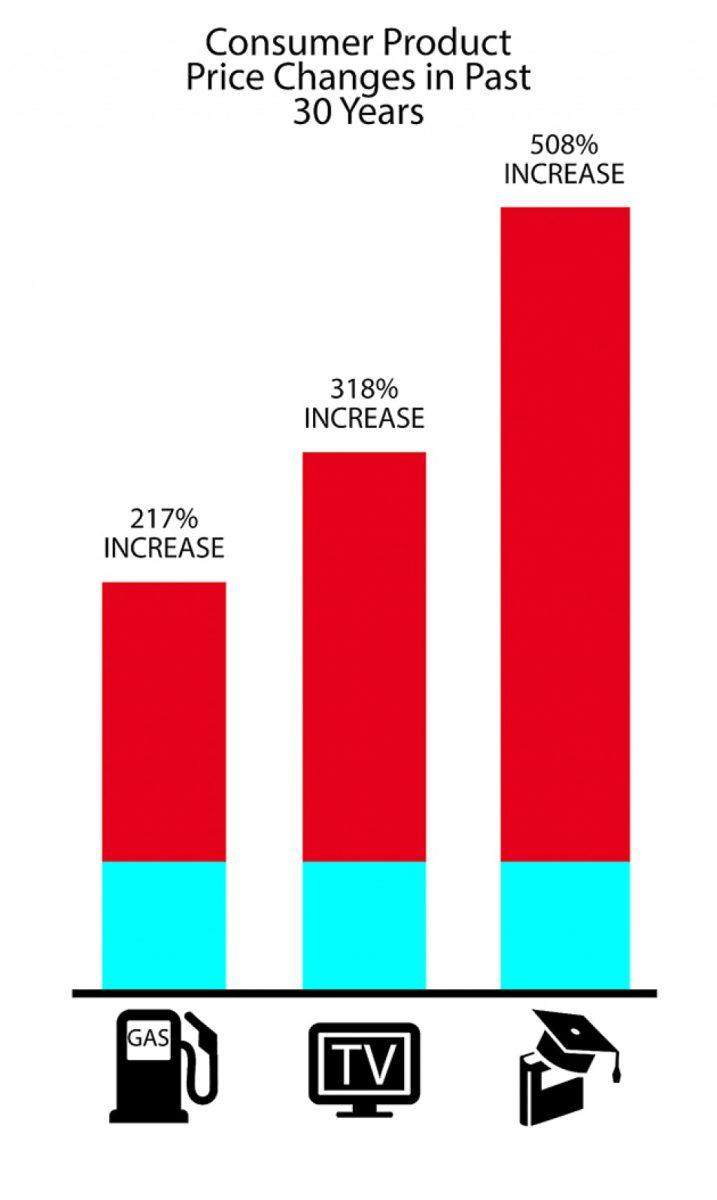

A dramatic change in prices over the last 30 years is accompanied by a shift in lifestyles, according to a blog by Mark Dotzour, chief economist of the real estate center at A&M, enumerating the price change in items that consume Americans’ income.

To name a few, Dotzour found that gasoline prices have risen 217 percent, cable and satellite TV and radio services have risen 318 percent and that educational supplies and books have risen 508 percent. In the past five years, electricity has increased 9.7 percent, coffee prices have risen 7.1 percent, while intercity public transportation has decreased 2.1 percent.

These data and others, he said, are not independent, but rather part of a larger trend.

“We have what I call a bifurcated market in America: two kinds of Americans,” Dotzour said. “You have people that own stocks, and have houses and both of those have gone up in price dramatically, so those people are wealthier. They’re able to spend and buy things. Then you have another segment of America that doesn’t own a home, and doesn’t own any stocks and their wages haven’t gone up very much for the past five or six years, and so they can’t afford to buy stuff.”

Dotzour said that budget-friendly stores like Wal-Mart and Target have seen a decrease in sales for the past five quarters.

“Their customers are under duress,” Dotzour said. “Prices are going up, wages aren’t. It’s a challenging environment right now.”

Dotzour said that these were long-term repercussions, not always felt immediately by the individual.

“When you’re young, you can afford to change jobs, and try to do better,” Dotzour said. “But maybe, for whatever reason, you get to your sixties, and you can’t do that, and you’re on a fixed income. And considering inflation, what then?”

Dotzour said that it is common for the Federal Reserve to create two percent inflation annually.

“What happens is the opposite of inflation would be deflation, where prices fall,” Dotzour said. “The economic calamity that happens in a country where prices fall is so bad that while it might be ideal to have on average zero percent inflation — what that means is that you’re going to spend some time below zero. The fear of this deflation is pretty large.”

While Dotzour said that this was a delicate situation to balance, he recommends younger generations and individuals in general to place their money, whenever they are able, into Roth IRAs. He recommends this particular kind of savings account, particularly because it is income tax free.

“Why this matters is, if prices keep going up, it’s hard to maintain a lifestyle if you haven’t saved,” Dotzour said.

Dotzour said that when people start to think about retiring, they often find out that they can’t truly afford to stop working.

“If you took the price of 12 things that you buy on a regular basis, and say, here’s what the price was in 2014 — if you kept that record and updated it in July of every year of the next decade, you’d have a very good understanding of inflation, and its implications if your wages don’t go up.”

Prices increase, Americans’ wages aren’t

July 13, 2014

Items such as gas, cable and satellite

TV services and educational supplies and

books, have seen prices increase

greatly over 30 years. Graphic by Josh Seal.

0

Donate to The Battalion

Your donation will support the student journalists of Texas A&M University - College Station. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover