Due to a new tax reform law, the American Dream is not out of reach today, according to United States Senator John Cornyn.

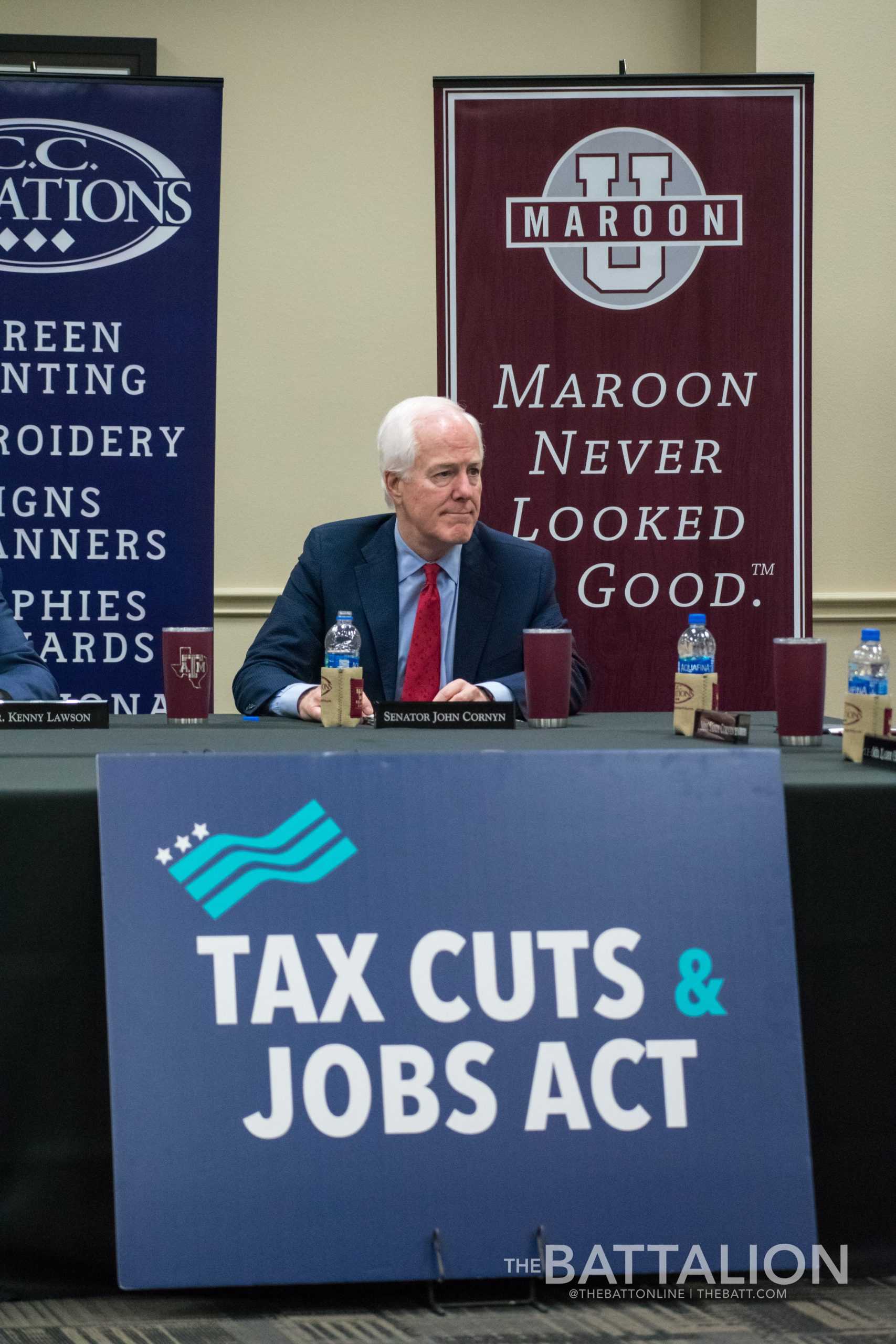

Cornyn met with four local business leaders Wednesday to discuss the Tax Cuts and Jobs Act, which was designed to allow small businesses to create job opportunities and invest in their employees. The meeting, hosted at C.C. Creations, began with a roundtable discussion, in which the local business executives shared stories of the law’s impact on their companies and employees.

Kenny Lawson, CEO of C.C. Creations, said he has seen the benefits of the new tax code in his company since it became law in December.

“I really think [the act is] doing exactly what the tax reform wanted to do,” Lawson said. “It’s money back in the taxpayers’ pockets and it gives businesses an opportunity to grow and use those tax deductions in a positive way.”

The Tax Cuts and Jobs Act allows small business owners to immediately write off the full cost of new equipment, write off interest on loans and lowers the corporate tax rate from 35 percent to 21 percent. These developments have led to growing businesses and a better economy, according to Cornyn.

“What I’m hearing here is what I hear everywhere around the state from small businesses, is that this has provided [small businesses owners] the ability to invest in their businesses, grow it, hire more people and pay better wages to the people who work there,” Cornyn said. “That’s exactly what we had hoped for when we passed this piece of legislation.”

Thomas Gessner, principal of Gessner Engineering, said the Tax Cuts and Jobs Act provides employees better job security, which allows them to settle into the community long-term.“If our employees have the opportunity to stay with us, grow with us, buy homes in our communities … then that’s really, from a professional services standpoint, that’s the best thing we can ask,” Gessner said. “We can have that retention, have them grow with us and keep them around. [The law] has enabled us to do that and it’s really important to us.”

Larry Hodges, president of Copy Corner, said his company spends more money on employee investment than on technology, a trend the new law has allowed them to continue.

“I looked at our team, and three out of our four main managers were all student workers at one point, and graduated [from] A&M and had an opportunity to stay because we had opportunities for them,” Hodges said. “So now, we’re able to aggressively reinvest in our people. I tell my managers, ‘We’re spending all this money on equipment all the time, but what you don’t realize is we spent more money on people than we do on all the equipment put together.’”

The new law has allowed businesses to pay lower taxes, enabling them to spend more on their employees through benefits, such as health care coverage. Claudia Smith, co-owner of Aggieland Carpet One, said these benefits are meaningful because it helps her prioritize her employees.

“Something that has kept me up all night lots of times, lots of years, is the increase in health insurance,” Smith said. “As a very small business, I am not required to provide that benefit to my [employees] but I always thought if you have a healthy staff, your company will always be successful. So that is something I have done forever, but it has continuously been increasing. I was thinking that I was not going to be able to provide that for my employees anymore, and now I can, under the new bill. So that brings me peace of mind because my employees are family.”

The Tax Cuts and Jobs Act results in more than just improved wages for employees, according to Cornyn, because it allows Americans to obtain an ideal they may have thought was impossible.

“Since the Great Recession of 2008, I think many Americans had come to feel that our best days were behind us,” Cornyn said. “What we’ve demonstrated here is that is absolutely not true. We can get the economy growing again, so people can find work. They can have more take-home pay and they can provide for their families and have the sort of things that, perhaps, they had come to believe were just luxuries and things they could not afford. So really, it’s about the American Dream.”

While he is proud of the new tax code, Cornyn said there is more work to be done. He said the individual tax rate, which is currently locked in for 10 years, should become a permanent factor in the law.

“We weren’t able to make the individual tax rates permanent,” Cornyn said. “That’s because of some complex procedures and budget rules, but I think what we ought to do here before the end of this year is have a vote, because I know everybody on the political spectrum, from Bernie Sanders on the left, to the most conservative folks in Congress, people like me, believe that we ought to make those individual tax rates permanent.”

Lawson said the Bryan-College Station community benefits from the law in a variety of ways, and said both cities have potential for continued success.

“Bryan-College Station is a very robust community and there’s a lot of good growth opportunities, so this really is even more impactful, I think, in this area,” Lawson said. “Different organizations view the tax reform differently, but I know that all of us have a consensus that it’s a positive thing in Bryan-College Station.”

Making the American Dream reachable

March 28, 2018

Photo by Photo by Jesse Everett

U.S. Senator John Cornyn discussed the Tax Cuts and Jobs Act with business leaders Wednesday.

0

Donate to The Battalion

Your donation will support the student journalists of Texas A&M University - College Station. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover