College is full of responsibility, and financial decisions are no exception.

Accounting professor Karen Farmer said students need to learn how to budget their money wisely, and each semester she assigns a budgeting assignment for her students, requiring them to budget their finances for the first six months of their “real life.” Farmer said students love the real-world applicability of the exercise and she wishes it could be assigned to all college students.

When it comes to handling money, business professor Shannon Deer said levels of financial independence vary within the student body, but she is most concerned with students who have no idea how to handle their money at all.

Mark Mielke, financial advisor for Money Wise Aggie, said students come into college with training in basic classes such as math, history and so on, but the vast majority have never had training in budgeting their money. Some students learn from their parents or friends but the most common factor in unwise budgeting is that students have not been trained to do so, Mielke said.

Mielke said he doesn’t think students are any worse than the typical American at paying their bills on time. However, he said people tend to fail to make a plan to maximize the joy money can provide, and in turn, minimize stress.

There are really only three things a person can do with money, Mielke said.

“You can spend it, you can save and invest it for future goals or you can give it away,” Mielke said. “All these things provide joy if used right.”

Although some students are financially conscious, mistakes still occur. Farmer said students sometimes put off being accountable for their money, thinking they will be more responsible after college. She said overspending and incurring debt leaves students with the problem of paying it off once they get a job.

“That thinking just defers the problem, and lack of financial awareness and overspending then become the norm during the student years,” Farmer said.

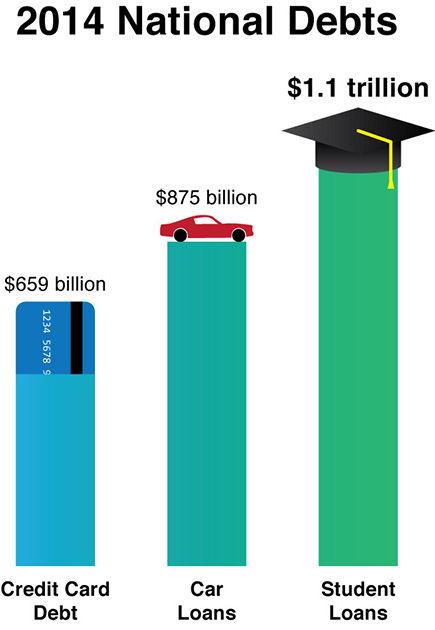

Mielke said a failure to pay off credit card balances is a common trend among college students. He said this could leave students with expensive interest, sometimes ranging from 20 to 40 percent.

Deer said she thinks the belief that student loans are free money is the biggest mistake students make about finances.

“It is so critical to borrow only what you need to successfully complete your degree, and not a penny more,” Deer said.

Investing in yourself for college is one of the best things a student can do, Mielke said, but it is important for students to keep their loans minimized. Mielke said something that helps students keep up with their finances is by working during their school semester.

“A lot of students here are such hard workers and we have one of the most active student employment offices in the country,” Mielke said.

Farmer said the decision to be aware of finances is key to improving one’s spending and saving. She said checking online balances frequently and establishing achievable goals will help students manage their finances well. Farmer said it is important for students to realize that living within one’s means is a choice that allows more choices in the future.

“You’ll be able to measure your success and see your savings — and self-discipline — grow. Patterns established early tend to endure,” Farmer said.

Mielke said setting up an emergency fund for unexpected costs and forming a budget are great ways to improve one’s spending. In the interim, he said students should complete their Texas A&M degree.

“Studies show that people with degrees earn a lot more money than those without,” Mielke said. “Actuarially, if you can earn that Texas A&M degree you are going to earn a lot more money over your life than if you don’t.”

Resources for managing finances are available on campus. Deer said A&M offers financial counseling programs to students through Money Wise Aggie.

Graphic by William Guerra

Professors, advisors emphasize financial preparation, training

September 13, 2014

0

Donate to The Battalion

Your donation will support the student journalists of Texas A&M University - College Station. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover