There are a few crucial keys to making a good start on personal finances in college.

To create a sustainable money management plan for personal finances students can utilize professional advising on campus, online resources or contact local financial advisors. The services provided by the university on campus and personal finance planners online or in phone applications can expand students’ abilities for maintaining proper spending habits.

One way to help save money is to look for things such as scholarships and grants for educational funds. TD ameritrade director of financial planning at Texas A&M Nathan Harness leads the financial planning program in the college of agricultural economics and said his biggest suggestion to students starting out is to find small scale scholarships and grants.

“Search for and apply for as many scholarships as possible,” Harness said. “Every year there is money at the university level, department level, and on-campus organizations have that aren’t funded to anyone.”

Harness said the on-campus resources help students find and apply for scholarships and grants that will fit their needs.

“In our financial planning program on-campus there have been two years that we couldn’t give out all of the scholarship money we had because we didn’t have applicants,” Harness said.

Using paper money for particular expenses helps keep track of how much you spend. Animal science senior Roxanne Lane said she decided her sophomore year that her budget was not tangible enough, so she began using only cash for all discretionary spending. Since then, she said that she has been able to stick to her monthly budget with serious discipline.

“The biggest thing I’ve noticed is when I don’t deal with paper money, I convince myself to never look at my bank account and then I finally look and wonder where it all went,” Lane said. “The use of paper money gives me a tangible feeling for how much I am losing every time I spend it. I am much less likely to make impulse purchases.”

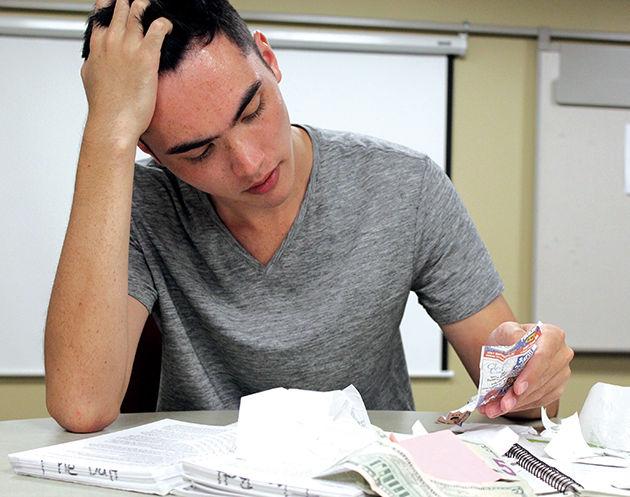

Harness said that students must develop good financial habits immediately.

“Start with any amount, but start saving something. Too many students think that they will start saving when they graduate,” Harness said. “The reality is that developing that financially health habit now makes you much more likely to save when you graduate. Research has found that those who begin to save early continue to do so as they approach young-adulthood at a much greater rate than those who wait.”

Lane said she has a savings jar that has paid off for her in a few times of emergency.

“I have a special occasions jar that I keep in my closet and put the leftover money at the end of every month in,” Lane said. “It has been enough to serve as emergency cash.”

Another resource included in every student’s university advancement fee is access to the Money Education Center. For undergraduates, professional or graduate students and alumni alike, they have classes, online training and one-on-one coaching available for no charge.

Nick Kilmer leads the Money Education Center and said he advocates for early and robust education of students on their means of saving money. He said the center aims to help all students take control of their finances and give them a chance to afford college and achieve life goals.

“Regardless of their background, degree, or future profession, every Aggie needs to understand their own finances because everyone has life goals which typically cost money and often involve the need to understand complex financial concepts,” Kilmer said. “Also, everyone faces unexpected financial setbacks, and being on top of their finances can help students manage setbacks and still afford their life goals.”

Both Kilmer and Harness said the new course offered in the fall, Foundations of Money Education, which will be offered for students interested in learning about money, is useful and will award an academic credit.

“This course is open to all majors and classifications on campus,” Harness said. “It is designed to teach students the application and actions they need to make to be prepared financially as they progress through college and enter the workforce.”