The trials and tribulations of college are plentiful. Of all the stressors that negatively affect mental health, it really is all about the money.

As students complete their degrees, financial responsibilities change. Financial obligations continue to evolve with each stage of life, contributing more stress to interpersonal relationships. Being able to cope with them is paramount.

Like most things, how finances make people feel can be traced to their upbringing. How someone approaches finances is heavily influenced by the spending behaviors that have defined their life.

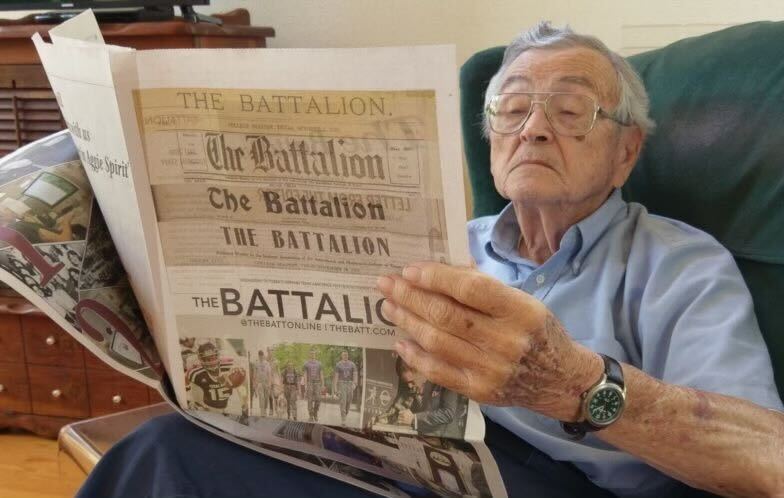

Money is heavily tied to a person’s emotional and mental state, said Dr. Mary Covey, Ph.D. and director of Counseling and Psychological Services at Texas A&M.

“People will say that it’s a necessity to have a phone, it’s a necessity to have cable TV,” Covey said. “And then, you’ll have other people for whom it will really vary based on their values and what they’ve been exposed to and how much they’ve been really given.”

Covey has been the director of CAPS since 2018. She sees first-hand the learning curve of early adulthood as a common cause of financial stress. She notes there is a stark difference between the financial responsibilities of college students and high school students.

“People are so excited in high school to work for minimum wage,” Covey said. “And then you realize in college ‘Wow. This is not going to support me; this isn’t what I need.’ So there [is] a huge reality check about money.”

Sociology senior and Bonfire chief Jett Reinhardt said he has had to carefully consider his finances when choosing where his next meal would come from.

“I’d often weigh the enjoyment of a meal from somewhere like Panda [Express] versus my ability not to starve the rest of the week and live off my ramen,” Reinhardt said. “It was rough, and I had to turn down a lot of invitations to hang and go out because I just couldn’t afford it.”

Carlton Orange, a finance graduate from A&M, agreed that college often pulls students apart in various directions and said he believes that money can often be the worst offender.

“Students now kind of have two separate lives,” Orange said. “Their work life, which includes school, sports, etc., and their social life, which includes hanging out with friends, and relationships with others. The problem starts when students let the stress of their daily responsibilities from their work-life spill over into their social life.”

When Reinhardt was a Bonfire chief in 2020, he noticed a rift with his peers caused by his financial shortcomings. After long days and nights at the stack, breakfast or dinner would cost too much to eat out.

“I was criticized by past leadership for wanting to go home and not stay with the crew,” Reinhardt said. “In actuality, I just didn’t want to sit at the table surrounded by friends eating when I myself couldn’t afford a meal.”

Apart from social spending, most students also worry about paying for their education. Three of the five most common stressors among college students are finance-related – repaying loans, the cost of tuition, and borrowing money for college – according to inceptia.org. The nonprofit works with schools and loan holders to understand financial information.

Junior microbiology major Aldair Monsivais grew up in Humble, and said he recalls growing up with a warm sense of community and understanding from his neighbors and peers in a place where financial hardships were not a rarity. Though Monsivais’ grades made

him a prime candidate for Houston magnet schools, his family’s bank account said otherwise.

“With a lot of the issues we were fac

ing financially as well during that time, it was convenient to find somewhere that was cheaper for us, and that ended up being Humble,” Monsivais said.

Today, Monsivais is a successful student who serves as vice president of the Council for Minority Student Affairs. He is also a DACA recipient. #UndocuMED trails across his bio like a Twitter badge of honor. He said it allows him to be open and visible about his immigration status, goals, and how only he can define himself. Even if Monsivais’ goals are concrete, he said he still relies on DACA to stay in the country while it stands on a legislative tightrope. The struggles carry over to the financial aid process.

“There’s a lot of additional steps that you have to take as an undocumented immigrant,” Monsivais said. “Not only do you have to do TASFA, you also have to do an affidavit of residency so you can be considered for in-state tuition and also have to make sure that information gets sent.”

Monsivais has provided comfort and assistance to people going through the same struggles he did through his role at CMSA. Just recently, Monsivais said he was able to help an undocumented student transfer to A&M by guiding them through the hoops of college admissions and financial aid. By doing so, Monsivais said he felt as though he was making up for going through that ordeal on his own.

“To be able to help someone who was going through the same situation I went through – it’s comforting to know that at least they’re able to have that help,” Monsivais said.

Finances are also a struggle for couples, especially among married ones.

“The first year here, my parents and myself were really, really struggling to even pay tuition, let alone rent and food,” Reinhardt said. “It was a burden that kind of loomed over myself to the point it influenced most decisions I made in day-to-day life.”

Monsivais said the tension was noticeable in his family as well.

“I think my parents do a good job hiding it. I can tell that they get stressed about it,” Monsivais said. “The money they have saved up for other emergencies has to go towards our rents because that is the emergency.”

Reinhardt said he resolved his money hassles when he learned how to balance spending and save his money.

“On an equally as important note for the stress mentally, I also found it was good to spend money when you could to just treat yourself,” Reinhardt said. “Money comes and goes, and there’s a balance to what you spend and what you save.

“Don’t blow it all away on take out or stash every single penny and live off the cheapest food possible because both of them hurt you mentally in the end,” Reinhardt said. “Finding the balance between financial stability and mental peace is the most important part.”

Making cents of it all

April 3, 2022

Photo by Hayden Carroll

Today, Sept. 1, federal student loan payments are set to resume, months after the Supreme Court struck down President Biden’s student loan forgiveness plan and a multi-year pause. Many Aggies aren’t worried, however.

Donate to The Battalion

Your donation will support the student journalists of Texas A&M University - College Station. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.