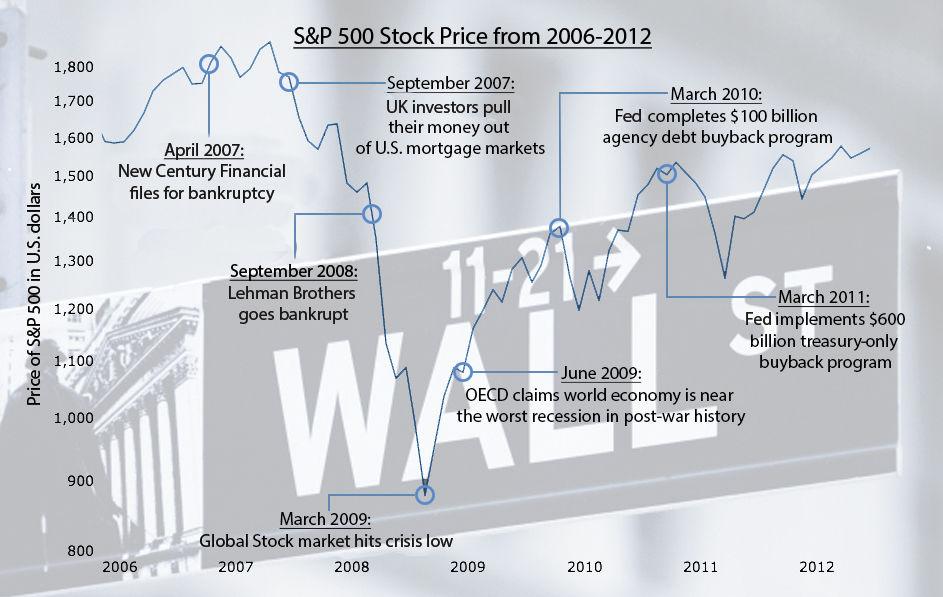

September 2018 marked 10 years since Lehman Brothers filed for bankruptcy, throwing the global financial industry into crisis and sending the U.S. economy into the worst recession since the Great Depression.

According to Bureau of Economic Analysis data, the economy is now growing stronger at an annualized quarterly pace of 4.2 percent, with unemployment at just 3.7 percent after spiking above 10 percent in 2009.

Some financial professionals predicted the crisis, with varying arguments, according to Anwer Ahmed, the department of accounting’s Ashley ‘88 and David Coolidge ‘87 chair in business.

“We just got a paper accepted for publication which shows that bank executives and directors with prior crisis experience did foresee or predict the 2008 crisis and took steps to mitigate the effects, such as limiting their exposure to mortgage-backed securities,” Ahmed said.

Regardless, Ahmed said most people in mainstream finance did not foresee or predict the depth of the crisis.

“They were earning such high fees or compensation from the transactions they engaged in that it distracted them from questioning the reasonableness of their assumptions,” Ahmed said.

With the benefit of hindsight, Ahmed said the financial crisis was deepened by some mix of government policies and private-sector actions.

“It was a combination of factors including government policies such as keeping interest rates low to stimulate the economy, deregulation of banking and inadequate supervision of markets like the credit default swaps market,” Ahmed said. “[Other factors included] incentive systems that motivated excessive risk-taking and deal-making, insatiable demand for securities that were considered low risk but offered relatively high returns and bursting of the real estate bubble.”

Some, like Nobel Laureate Paul Krugman, argue that the government did not spend enough time and energy helping homeowners, which would have prevented some of the worst effects of the crisis.

“I am not aware of any evidence to support this argument,” Ahmed said. “If people were granted loans that they could not afford, then it is not clear that government refinancing would have prevented the crisis.”

The primary cause of this financial instability was the housing bust, according to James Gaines, chief economist at the Texas A&M Real Estate Center.

“The housing bust was created because people were allowed to buy housing with little credit,” Gaines said. “They were buying housing way over their capacity to pay for it. And then that ultimately, over the course of three or five years, caught up with it and people started defaulting on loans.”

Gaines said the housing bust, and the systemic risk created by the easy sale of home mortgage-backed securities, explains why the financial crisis was so deep.

“All of a sudden, people were getting loans to buy a home, regardless of their credit qualifications because the the institution making the loan knew they didn’t face the collection risk,” Gaines said.

Ahmed said the Federal Reserve’s widely unpopular but effective bank bailouts helped put the economy back on track.

“The Federal Reserve had to step in to save the banking system because without that, the crisis would have been worse and more widespread,” Ahmed said.

At the time of the crisis, assistant professor of finance David Skeie was working at the Federal Reserve Bank of New York, which supervises and regulates financial institutions in addition to its typical role implementing monetary policy. He recalled how former Chairman of the Federal Reserve Bank of New York Timothy Geithner stressed the importance of exploring all options for stabilizing the financial industry.

“He always projected a real sense of calm,” Skeie said. “But in meetings, well back in August of [2008], when [there was] the first sense [that] there could be a crisis, he was doing everything to figure out how to keep things from blowing up.”

Skeie said despite legitimate criticisms of the decisions that were made by government officials during the crisis, people should keep in mind the entire picture of the situation that these officials were responding to.

“I think there’s definitely a lot of blame that could go around for what led up to the crisis,” Skeie said. “But it wasn’t so much anybody particular’s fault. I don’t think anybody was especially negligent in any of these exact different bodies. It’s just simply not thinking outside the box about what potentially could really go wrong.”

A&M researchers reflect on the 2008 recession and its causes

October 21, 2018

Photo by Graphic by Jesse Everett

Statistics and other information via Schroders asset management company and federalreservehistory.org.

Donate to The Battalion

Your donation will support the student journalists of Texas A&M University - College Station. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.