Despite low U.S. oil prices, U.S. producers are still pushing to end a four-decade-old export ban on crude oil and natural gas. And according to a recent study by two Texas A&M researchers, it’s time for the ban to go.

The ban was enacted by lawmakers in the 1970s to keep production domestic after American aid to Israel caused OPEC, an intergovernmental agency in the Middle East that aims to unify petroleum policies, to impose an oil embargo on the United States, leading to skyrocketing gas prices and fuel rationing. Lawmakers also imposed price controls on crude oil to combat inflation.

By executive order in 1981, former President Ronald Reagan put an end to the price controls on crude oil in the United States, but did not put an end to the ban on exportation. Reagan said he wanted to ease the situation by letting freedom solve the problem through the “magic of the marketplace.” Since then, no president has made any move on the export ban until Barack Obama.

Those who support lifting the ban saw a glimmer of hope in December when the Obama administration allowed select companies to ship lightly processed oil in an attempt to help compete in a world market with cheap crude oil.

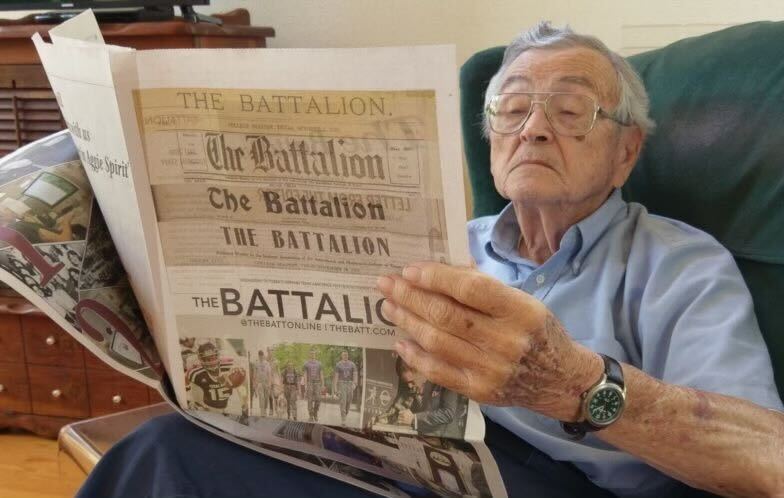

With Obama’s move again stirring talk about the ban, A&M researchers Gregory Gause and James Griffin, professors at the Bush School of Governance and Public Service, have released a study titled, “Free Trade in Oil and Natural Gas: The Case for Lifting the Ban on U.S. Energy Exports,” arguing the ban hurts the United States both from a security standpoint and an economic standpoint.

In the study, Gause and Griffin said supporters of the energy export ban insist the ban serves a number of domestic interests, such as keeping gasoline prices low, supporting the profits of domestic refiners and keeping a steady supply of liquefied natural gas for U.S. petrochemical plants.

However, in the study Gause and Griffin argue these arguments do not hold up because they ignore the global nature of energy markets.

Gause said the export actually increases the likelihood of allowing any oil embargoes against the United States again by adding our own oil to “the bathtub,” or the world supply of oil, keeping oil prices low.

“With prices low now, the leverage of oil exporters like Russia and the OPEC countries is down,” Gause said. “Having American oil potentially on the world market — even potentially, doesn’t have to be a lot of American oil on the market — makes it less likely that these oil producers can regain leverage.”

Griffin said fracking, or the process of extracting oil from shale deposits with water pressure, in the United States has unlocked

vast supplies of natural gas that could help U.S. and European trade partners escape any leverage Russia could have.

“Meanwhile, the EU depends on Russia for about half of its natural gas supplies and pays a monopoly price,” Griffin said. “Unlocking our vast domestic supplies is good economics here at home and good for our trading partners in Europe and Asia.

Gause said the United States is holding out on its trading partners economically.

“The argument is that we as a country are committed to free trade,” Gause said. “Why should our trading partners be denied access to a tradable good like oil, when we do not want them to deny us their tradeables and we want our other products to be able to enter their markets?”

Allowing American oil to be exported might marginally increase the price of oil locally, Gause said, but it would help smooth out global price fluctuations, which would provide for global economic stability and that, in the long run, is good for the United States economy.

Lori Taylor, associate professor in the Bush School and director of the Robert A. Mosbacher Institute for Trade, Economics and Public Policy, said the primary point Gause and Griffin are trying to get across is that the oil industry and economy is global.

“The price of oil is set in a world market — the price of gas, less so, but still heavily influenced by global economic conditions,” Taylor said. “And so the United States essentially imposing a ban on exporting U.S. product harms the United States without any real impact on the rest of the world.”

The Mosbacher Institute funds research like the study by Gause and Griffin. Taylor said the study is aimed at policy makers and policy influencers.

“We are trying to make sure that whatever decision-making occurs in Washington and Texas is well-informed and that policy makers are fully aware of the implications and the sting of prospective policies,” Taylor said.

A&M study adds a voice to oil export ban debate

February 9, 2015

Tanner Garza — THE BATTALION

Removing the ban on American oil exportation may cause local oil prices to increase, but would ultimately lead to increased global economic stability, an A&M study says.

Donate to The Battalion

Your donation will support the student journalists of Texas A&M University - College Station. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.