On Nov. 11, Texas Federal Judge Mark Pittman, ruled that President Joe Biden’s loan forgiveness program was an “unconstitutional exercise.” This came after Biden and Vice President Kamala Harris announced in early October their 3-part student loan forgiveness plan which includes federal loan forgiveness up to $20,000.

The lawsuit was brought to Judge Pittman by the Job Creators Network Foundation, or JCN, a conservative group which filed on behalf of two student loan borrowers. Although this program was already on a temporary halt by the 8th U.S. Circuit Court of Appeals, this block is more substantial and will take more work to overrule, according to the Texas Tribune. The Biden and Harris administration along with the Department of Education has already announced they have begun appealing the decision made by Judge Pittman.

The program is divided into 3-parts: extending the student loan repayment pause, specific relief to low and middle income families and ensuring the student loan system is more manageable for the future. This program said eligible loan borrowers must make less than $125,000 for single-households or $250,000 for spouses. At the start of November, the program was planning to forgive up to $20,000 for around 40 million borrowers. As of Nov. 30, the student loan forgiveness program was still blocked and applications are not open.

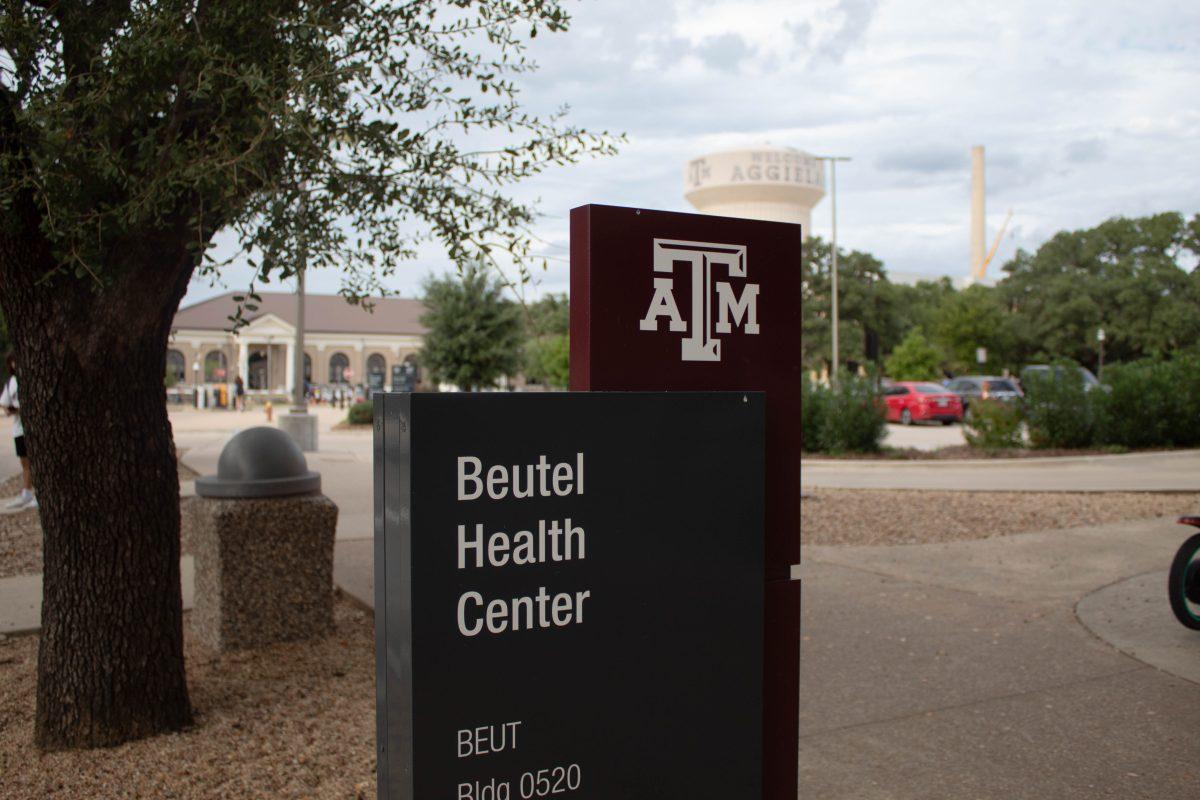

For many students, this loan forgiveness program was an important step to securing future financial stability. Assistant Vice President in Enrollment Services Delisa Falks said Texas A&M is supporting students through this process of student loan forgiveness.

“The Aggie One Stop is a place for students to go for financial aid advice. As well, there are financial aid and enrollment advisors who can help them answer questions,” said Falks. “If you need to sit down with someone, students can schedule an appointment with advisors to find out more about repayment plans and questions specific to loans. However, the best place to go at this point is the Department of Education’s website.”

The Federal Student Aid website has current information over the litigation that the Department of Education is pursuing to overrule the block from November. The website is being updated daily on new information and sign-ups for information can be found here.

“The Student Aid government website will have information regarding student loan repayment,” Falks said. “There is a program called Public Student Loan Forgiveness. I encourage students to go to the website and find information about student loan repayment.”

In the plan along with student aid relief, there was an additional extension of the current federal aid repayment pause. This pause has been ongoing since February 2020 due to the COVID-19 and the financial crisis that arose from the pandemic.

“If students have graduated from Texas A&M who were in repayment, the repayment pause is going to end in January of 2023,” Falks said. “However, this won’t affect most currently enrolled students due to being in deferment.”

Student loan debt has experienced a lot of changes implemented in the past year.

“Student loans are not necessarily bad debt,” Falks said. “Sometimes it is necessary to borrow to pay for education. We don’t know what the future holds and what future administrations may offer for student loan debt relief or payment options. I always encourage students to borrow wisely and borrow what you need so you can maintain a low student loan debt.”

According to A&M’s Office of Scholarships & Financial Aid, around 29% of all students receive a federal loan to help pay for college. Public health senior Mariana Salomao said her choice to take loans was driven by academics.

“I got my loan to be able to not have to work during college so I can focus on school,” Salomao said. “I had to make the decision for what was best for me and what would work for me to be able to finish school.”

Before Biden’s Student Loan Forgiveness Program was blocked, the administration had already approved 16 million students to have loans forgiven.

“I was very much excited for the loan forgiveness to come out. There’s a reason why I got the loan — I needed it,” Salomao said. “Not having to pay all of it back, or even a little bit of it, would be a great relief to me after graduation.”

During this waiting period for students to hear back on if the block will be lifted, many students are unsure of their future financial situations after graduation.

“It’s really stressful and frustrating, because you think you won’t have to worry about paying these loans back,” Salomao said. “I’m about to graduate so I would have to start paying my loans back immediately after. There is so much stress being a graduate and trying to find a job and a place to live. All of that stress would be taken off from the loan aspect.”