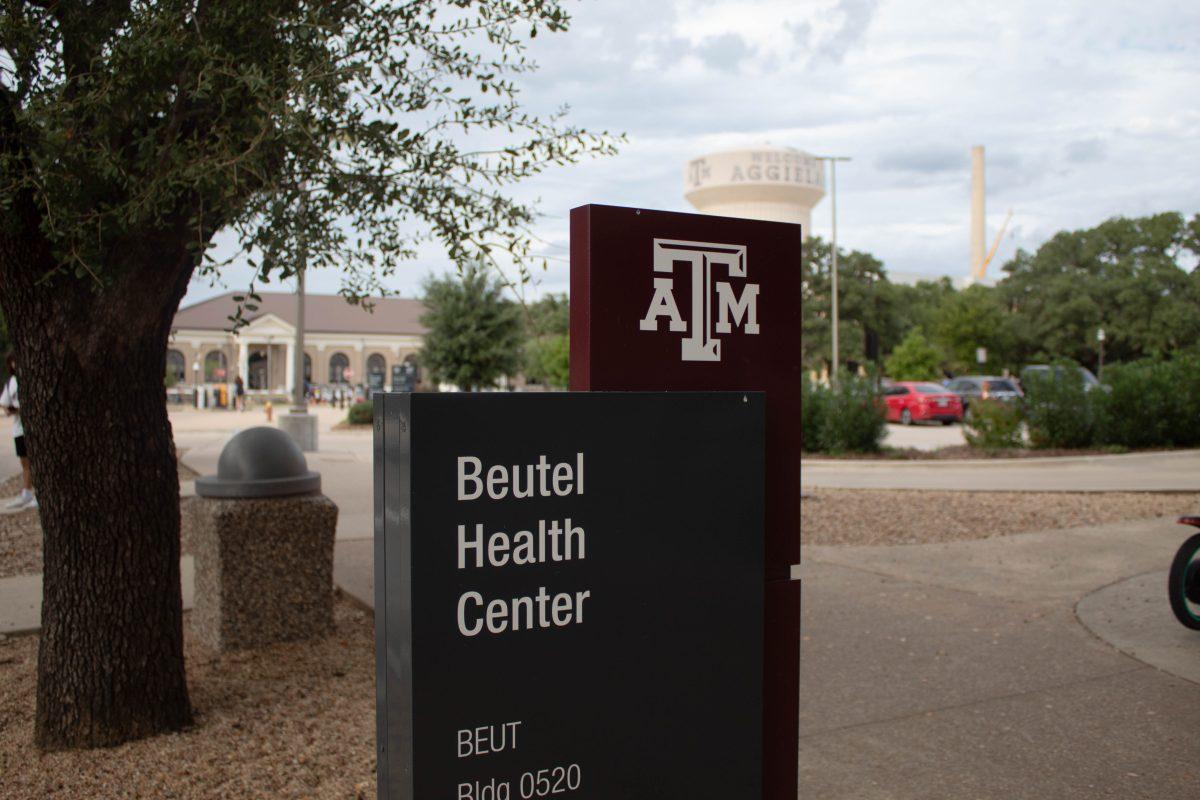

The $10,000 federal student loan relief will allow a less stressful college experience to eligible Texas A&M students.

On Aug. 24, President Joe Biden addressed the nation on the changes implemented by providing a loan forgiveness plan. The plan is designed to assist those in need of extra financial assistance. Students must meet certain requirements to receive student loan relief.

According to CNBC, students can check their qualification eligibility by checking their 2020 and 2021 tax return.

“Check if you are a Pell Grant recipient and qualify for additional relief by logging into your Free Application for Federal Student Aid [or FAFSA] account with your FSA ID,” the article reads.“The portal should have your student aid report [or SAR], which details the different financial aid awards you have received, including any Pell Grants. This information is also included in the financial aid award letter you received from the school you attended.”

Agriculture communications and journalism junior Maci Childress said the loan forgiveness plan would be an advantage for her family.

“Coming from a family of five, money has always been a big issue,” Childress said. “The student loan forgiveness plan would take a huge weight off my family’s shoulders, by providing a little relief towards my student loans.”

Caly Holyfield, Class of 2022, said the financial aspect of being a recent graduate student has its struggles.

“I am paying for all expenses, freshly out of school while also trying to manage my money as best as I can,” Holyfield said. “I am trying to get adjusted to a new job as well. It can start to feel overwhelming.”

Childress said she is interested to know more about this forgiveness plan overall.

“With this being a new plan I am unfamiliar with it, but I would love to learn more about it,” Childress said. “I would generally like to know more about how much relief could go towards my specific student loans and how to get started with the process on that.”

Holyfield said the student loan relief plan could really be of assistance to several young adults trying to manage their financial state.

“In my opinion, I believe that this is something that could really benefit a lot of students like myself just trying to juggle life,” Holyfield said. “It’s almost like one less stressful thing to worry about when freshly getting on your feet.”

Childress said this would not only be beneficial as of now, but will relieve stress in the upcoming years.

“I think this plan would take a lot of stress off my parents while I’m still in college,” Childress said. “This plan will make my student loans cheaper to pay back, therefore me and my parents have less to worry about.”

Childress said there is no certainty or guarantee on the plans after college, especially financially.

“As I am trying to look into where and what direction I want to pursue [in] my career after college, there is no guarantee on what my finances will look like,” Childress said. “All I can do at the moment is plan and figure out how I can organize those finances early on when it comes to saving money for my college loans.”

Holyfield said A&M has provided her with a wonderful opportunity of a lifetime, even when the stressors of student loans come to mind.

“I do feel as if A&M has fulfilled me with plenty of opportunities,” Holyfield said. “The educational growth makes all the difference and [it is] worth the hassle of paying off those student loans. The good news is that I can hopefully have some of that student loan debt wiped clean.”

According to CNBC, signing up to get notifications from the Department of Education on federal student loan borrower updates can give efficient up-to-date information on when applications are available.

“Check your communication preferences on your FAFSA and loan servicer accounts so you know where, and how, these agencies will contact you about receiving debt relief,” the article reads. “Have documentation of the outstanding balance on your loans and copies of your recent tax returns prepared in case you need to prove your eligibility.”