Picture this: you’re diabetic and making the median salary of an American citizen — around $35,000 a year. That’s about $2,900 a month. You live in Houston with a monthly rent of $1,300. Between city life, bills, groceries, savings and other expenses, you’re left with not much at all. Now add in the average cost for a vial of insulin at $98.70 and you’re in trouble.

The problem with these prices is that it’s not a pass-a-bill fix — it’s systemic.

It’s not just insulin, it’s plenty of other medications, operations and doctor visits. Take, for instance, my mom: she was diagnosed with epilepsy over 10 years ago. The amount of times I’ve heard my parents frantic over the price of medication that she has to take every day is heartbreaking. One of her most recent medications, Vimpat, costs $2,700 a month. It just isn’t feasible for anyone.

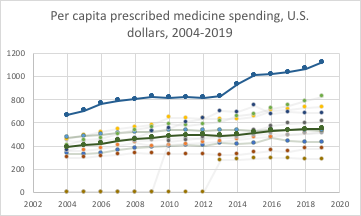

A study in 2020 found that 1.1 million Medicare recipients will die from not affording their medications in the next decade. In 2019, it was reported by Gallup that 34 million people knew someone in the past five years who had died because they couldn’t afford needed medical treatment. U.S. medications, on average, are 2.56 times the cost in other countries.

[Source: Health System Tracker 2022]

There are plenty of factors that go into the costs of prescription medications in the U.S. Take inflation, when inflation occurs, healthcare costs rise. However, it’s deeper than that. A study done in 2019 found that brand-name medication costs rose 9% annually and injectables rose by 15%, whereas inflation at the time was at 2%. So yes, inflation does factor into the astronomical medical prices Americans see daily, but it’s not the entire picture.

In addition to that, factor in research compensation. In 2021, the U.S. ranked first in science and technology across all other countries. While funding research for medicines and what-not is exceedingly important to the welfare and success of future generations, it’s also not the main reason for high prices.

It’s the lack of competition and government regulations.

To give context, healthcare in America was created by accident — which could explain why it’s a travesty. It started during World War II when then-President Franklin Roosevelt implemented wage controls, which didn’t account for regulating potential benefits in the workforce. In order for employers to attract more workers, they started offering attractive healthcare benefits. Then in 1943, the Internal Revenue Service implemented into law that employer-based healthcare should be tax-free. As a result, today we’re left with healthcare predominantly through employers and egregious medical inflation.

It’s a problem that needs to be solved. A problem that’s seen attempts at mitigation for a while now. Most recently, the House passed the Affordable Insulin Now Act, which from a distance looks nice. It would cap insulin prices at $35 per month, but if you dig a little deeper and read between the lines, you’ll see issues. Capping these prices without changing the system that produces them would cause a domino effect. For instance, only insured Americans would qualify for this cap. Then you’d need to anticipate that insurance rates would increase to accommodate for the loss of revenue.

The Trump administration also attempted to pass a bill to lower costs, but that wasn’t effective either. All of this to say, a full deconstruction of our country’s healthcare system is what we need to be focusing on. A subtle change to a component of a struggling system isn’t going to do the job effectively — it’ll just cause more issues.

It’s ridiculous that in such a powerhouse of a country America is, millions of citizens can’t afford basic care. In America, having a baby costs on average $10,000, riding in an ambulance is over $1,000 and getting a bandaid in the hospital costs $629.

Yes, insulin prices are a problem — but not the only one. The entire foundation of our healthcare system is the problem. Without reconstructing it from the bottom up, we’ll be lucky if we can even afford to look in the direction of the hospital without filing for bankruptcy.

Kaelin Connor is a psychology senior and opinion columnist for The Battalion.