After weeks of heated debates by the Brazos County Commissioners Court, the tax rate has still not been approved for 2022.

The court planned to approve the rate at its meeting Tuesday, Sept. 27, however, they needed four commissioners present for the vote, and only three were in attendance.

The court has until Oct. 21 to approve a rate of up to $.4735 per $100. The council has held workshops and meetings to discuss the rate including a workshop on Monday, Sept. 26.

A proposed rate, $.4835 per $100, would have raised revenue by 15%, though the rate is 2% lower than last year’s, $.4935 per $100. This is due to the increase in property values.

The voter-approval tax rate is at $0.518466 per $100, and is the highest tax rate the county may adopt without seeking voter approval on the rate.

The no-new-revenue tax rate stands at $0.429411 per $100, which would raise the same amount of property tax revenue for Brazos County from the same properties in both the 2021 tax year and the 2022 tax year. If the court doesn’t reach a conclusion by Oct. 21, the tax rate will automatically be set to this rate.

At the Monday meeting, Precinct 1 Commissioner Steve Aldrich said he wanted a rate that would not significantly raise costs for citizens.

“[A rate of] $0.4435 per $100 is neutral to the average homeowner with a homestead exemption in Brazos County,” Aldrich said.

The court was unable to reach a decision at the Monday meeting.

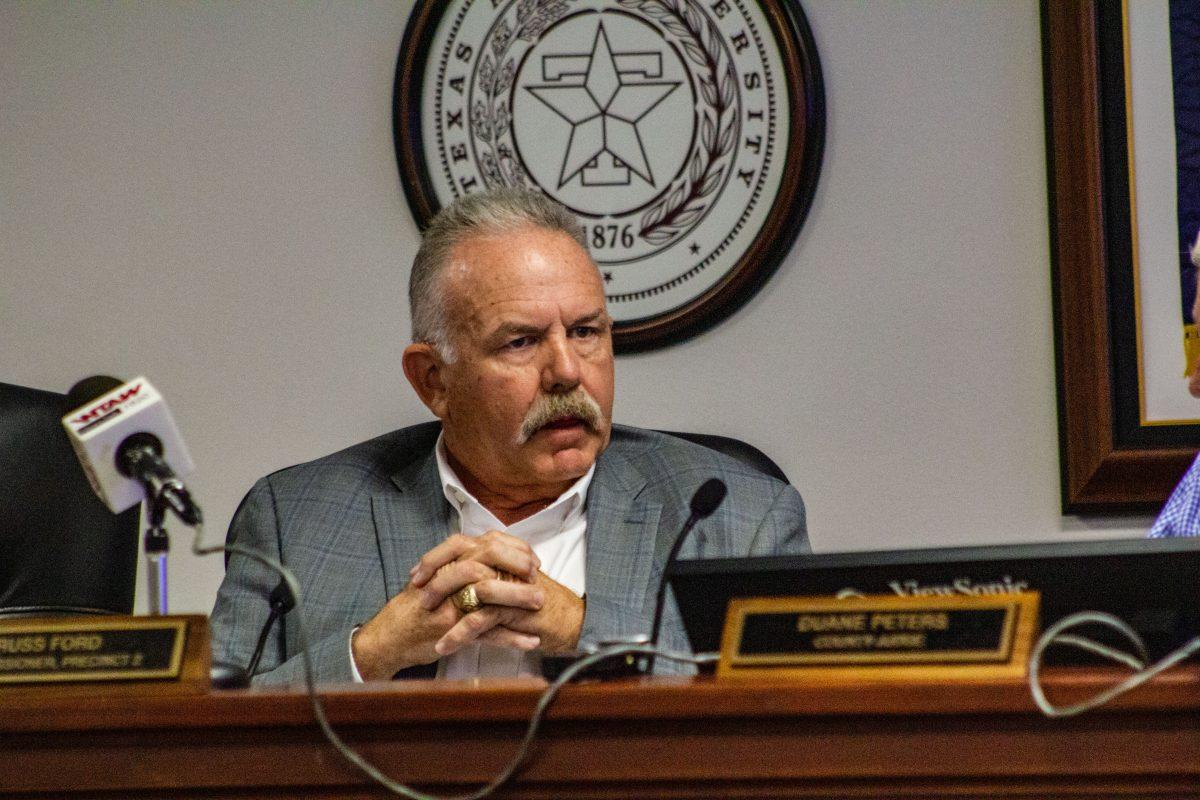

“What I hoped for today was that we could possibly discuss a tax rate that’s different than what would be proposed and that we could at least get a feeling where the court would move on that,” Precinct 2 Commissioner Russ Ford said.

There is no current, confirmed date that the court will approve a rate.

“I have, from the very beginning, stated how, what I felt or thought,” Precinct 4 Commissioner Irma Cauley said. “I’m not going to take anything back. I think it’s time for us to do the work of the county.”