Federal student loan payments resume Friday, Sept 1 after a pause dating back to the start of the COVID-19 pandemic in March 2020.

As of 2022, more than 44 million Americans owed a combined $1.7 trillion in student loans, with one expert estimating student loan debt “could topple $3 trillion by 2035,” according to CNBC.

The Biden administration argued the 2003 Higher Education Relief Opportunities for Students Act gave it the power to “waive or modify” loan provisions for borrowers affected by a national emergency, with Biden claiming the student loan crisis constituted such an emergency. Biden’s plan included forgiving $20,000 for indebted Pell-eligible Americans and $10,000 for everyone else with federal loans.

States sued soon after, disagreeing with the claim, and the issue was elevated to the Supreme Court, where it was struck down in a 6-3 vote along ideological lines on June 30.

Additionally, to avoid a government shutdown, Biden made a deal with House Speaker Kevin McCarthy in May to increase the nation’s debt ceiling for two years. There, McCarthy pushed for payments to resume, resulting in the Biden administration losing the ability to extend the pause.

In the United States, 55% of students from public four-year institutions graduated in debt, averaging around $28,950 per student.

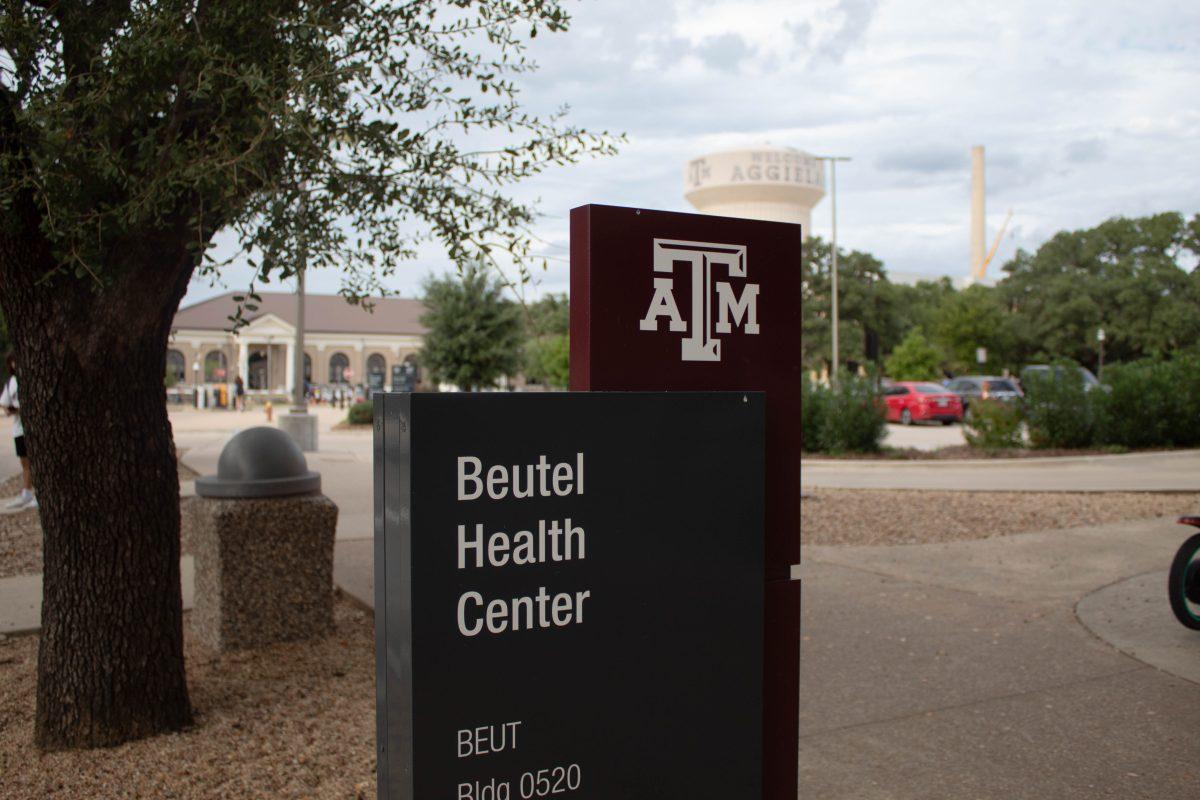

But the average is lower at Texas A&M, where only 40% of undergraduate students were indebted at graduation with an average of $23,989 in the 2021-22 school year, according to the university.

For the 2023-24 and 2024-25 academic years, the Texas state legislature also froze A&M’s tuition for undergraduate students, guaranteeing no price increases for two years.

The estimated tuition and fees for the year is $11,550 for undergraduate students, with costs varying by major and tuition rate code, according to A&M. That’s less than half the average cost of attendance for public institutions in the country, which averages $26,000, according to the National Center for Educational Statistics.

From 2008 to 2018, the average tuition at four-year public universities in all 50 states increased by 37%. After adjusting for inflation, 41 of those states spent less per student after 10 years, with Texas spending $2,149 less per student in 2018 than it did in 2008.

The Center on Budget and Policy Priorities stated that as state funding drops, it results in “rapid, significant tuition increases” as more costs are pushed onto students.

But despite the controversy at Capitol Hill, many Aggies in College Station aren’t worried, such as economics senior Caleb Hill.

“[Student loan forgiveness] didn’t really apply to me, so I wasn’t super upset about it,” Hill said.

Hill said his taxes shouldn’t go towards paying off others’ loans.

“If you’re paying taxes to go to the government, I don’t think it should necessarily go to other people’s student loans because, at the end of the day, they did take out those loans on their own,” Hill said.

Accounting senior Jason Ryder disagreed and said students take out loans because they need help.

“I see where that comes from, because it is annoying if people pay for their own college and then other people get their college forgiven, but at the same time, not everyone can afford it,” Ryder said. “Not everyone’s given the same opportunities. I feel like it’s very specific on the person, per individual.”

Sociology freshman Emma Slauson concurred, stating she’d support a future forgiveness plan if it were ever reintroduced.

“I think that people who need loans, need those loans,” Slauson said. “If it has to come from taxes, then it has to come from there.”

She stated that while she has no loans, she understands many who take out loans often do so out of necessity.

“I’d probably support [loan forgiveness],” Slauson said. “I mean, people obviously need the money, so I’d support it in any way I can.”

The exact reasons for the large growth in debt aren’t clear to students.

“[Student debt] is probably growing because people in the past that wouldn’t have gone to college right out of high school now think it’s so important that they’re willing to put themselves in debt to go,” Hill said.

Ryder stated he believed the crisis is due to expensive schooling relative to low-paying jobs, as “it’s hard to pay $300,000 worth of loans when you’re only making $40,000 or $50,000 a year.”

“I think everyone should be given a fair shot, but I don’t know, it’s not the world we live in,” Ryder said.