Due to the increase in demand for oil in recent months amid the COVID-19 pandemic, production has been slow in sufficiently responding to the necessary supply. In order to combat this lack of supply, the Biden administration has announced its plan to combat rising prices.

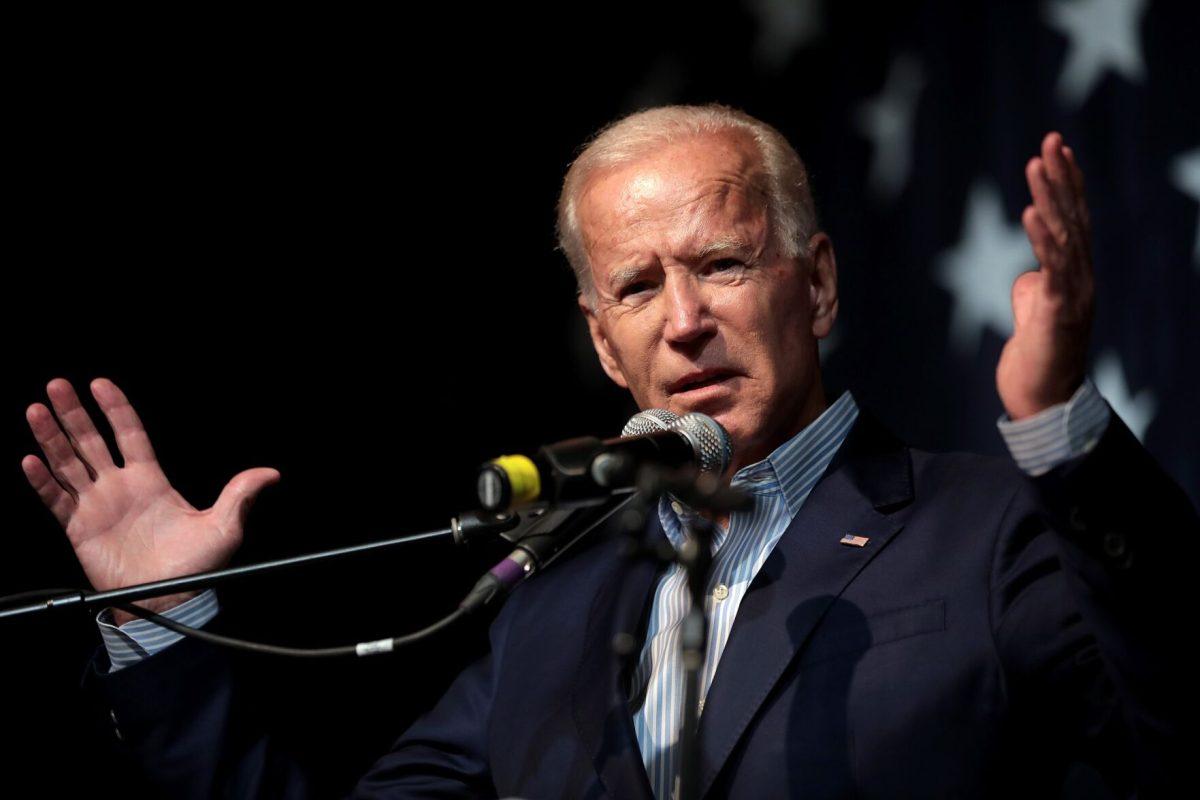

On Nov. 23, President Joe Biden announced his administration would utilize the Strategic Oil Reserve, or SPR, to release 50 million barrels of oil in response to rising prices and lack of supply. This action is in part attempting to control his waning approval ratings as the economy struggles to recover from rising inflation exemplified through rising prices at the pump.

Dennis Jansen, professor of economics at Texas A&M, said the oil market is pertinent in the global economy.

“Oil is a worldwide market; every country uses oil in some form or another. The total consumption is about 100 million barrels a day, and the U.S is 18 or 19 million barrels a day,” Jansen said.

Jansen said the shifting demand for oil due to the COVID-19 pandemic has created a supply shortage.

“In the U.S back in November 2019, oil production hit a peak of 13 million barrels a day. In September 2021, production fell to 11 million barrels a day, which is actually quite a large fall,” Jansen said.

When asked about the drivers of the price of oil, professor Jansen said this was a supply and demand issue.

“The price is dependent on the supply and demand of that product,” Jansen said. “When demand goes up, it takes a while for production to respond and some when demand goes up, until production follows along, you will see the price of oil rise.”

Professor of petroleum engineering Peter Bastian said the process of oil extraction from the earth is dependent on several factors.

“The method of extraction is always a function of the properties of the oil reservoir, as well as the fiscal climate where the oil is found,” Bastian said. “The origins of oil in nature, contrary to what most people think, exists in micro-pores in solid rock. If you can imagine a sponge and look at the cellular structure of a sponge, it has solid structure and has pores that hold oil.”

When asked about how prices have changed in the past few years, Jansen said the price of oil fell due to a decline in travel.

“Back in the early days of COVID-19, people were staying home, not flying and the price of oil was way down, where the price per barrel was around 20 dollars,” Jansen said.“Demand fell, and thus production fell later on.”

As a supply-and-demand issue, James Rogers, a professor of political science, examined the ways in which a government institution can affect the prices for commodities such as oil.

“Drawing on what is called real business cycle theory, the president has a small ability to actually affect the economy,” Rogers said. “Only unexpected changes in the money supply can have an effect.”

Rogers said there are several possible reasons Biden is utilizing the SPR, comparing economic and political reasons.

“The political reasons track that, one crucial part of support for the president and the presidential vote is how the economy is doing. People respond to their pocket books.”

Aware of the relationship, Rogers said the prioritization of the price of oil has a major effect on the public.

“Critically, oil is a gasoline and is one of the most public prices. You can drive down the street and see the price change so people don’t only feel it but they also see it,” Rogers said.

Because the economy is an integral part of presidential approval ratings, Rogers said the subsequent actions and their consequences will show, not only in the economy, but in his approval ratings.

“Biden isn’t just worried about inflation as an economic phenomenon but also a political phenomenon,” Rogers said. “It surprised me that he tapped the oil reserves, but it’s understandable politically and there is also economic cover for that action as well.”

Although inflation is increasing, Rogers said the consequences impact President Biden’s approval regardless of how the economy performs.

“Contrary to what many voters believe, the president has very little to do with the real economy,” Rogers said. “But because he is perceived as taking public action, he is seeming to be responsive, which has an independent political consequence irrespective of the economic consequences.”