If you were to ask ordinary people on the street for their idea of what constitutes a fair tax system, some would say the rich should pay more of their income than the poor. Others would contend that everyone should contribute the same percentage of their income, regardless of how much they make.

Hardly anyone would argue that the poor should contribute more of their income than the rich, yet that is exactly how the Texas tax system works. In fact, according to the Institute of Taxation and Economic Policy, the bottom 20% of earners in Texas pay an average of 13% of their income in taxes, while the top 1% pay only 3.1% — a four-times difference. For comparison, the bottom 20% must pay less at 11.4%, 10.5% and 8.7% in New York, California and New Jersey, respectively — all of which are notorious “high tax” states. Even the middle 60% must pay less in California at 8.9% than in Texas at 9.7%. One is left to question which states are actually “low tax” and which are “high tax.”

Texas has such regressive taxes because it largely depends on its sales tax for revenue. Texas’ state sales tax rate of 6.25% is the 13th highest in the union, and local governments can charge an additional 2% if they want, resulting in a total sales tax of up to 8.25%.

Proponents of the sales tax submit that it is fair because it is based on one’s level of consumption, meaning that the consumer can control how much they pay in taxes by choosing how much they consume. However, no consumer can escape the sales tax unless they are willing to be naked and illiterate, as clothes, books and school supplies are all subject to the tax. Since low earners generally spend more of their incomes on gas, clothes and other goods subject to the tax than high earners do, the tax hits low earners harder than high earners.

College students are especially burdened by the sales tax because many of them purchase dining plans or hot meals, neither of which are exempted from the tax. For instance, if a student at Texas A&M spends $1,773 on a Block 135 meal plan, they must pay an additional $146.27 in sales taxes.

In addition to its sales tax, Texas derives its revenue from property taxes, which are also regressive, albeit to a lesser extent. The tax is regressive in part because property taxes are taken by local authorities, such as school districts. As a result, wealthier school districts are able to meet their needs with lower rates because they have higher tax bases due to their property values being higher. Poorer districts, on the other hand, must charge higher rates to achieve the same revenues.

Furthermore, the state of Texas only offers a $25,000 homestead exemption, meaning that only the first $25,000 of a home’s value is exempt from the property tax. This exemption is lower than what many other states offer. Since homestead exemptions have a progressive effect, seeing as they offer the same relief to homeowners of all incomes, the fact that Texas’ exemption is as low as it is makes its property taxes more regressive. Additionally, the property tax presents a barrier to those who aspire to become homeowners, including many students at A&M.

Our state’s leaders should seek to alleviate the stress on those who are burdened the most by making the tax system less regressive. Unfortunately, any measures they have proposed have gone in the opposite direction.

For example, in 2019, Gov. Greg Abbott, Lieut. Gov. Dan Patrick and then-House Speaker Dennis Bonnen attempted to raise sales taxes from 6.25% to 7.25%, in the hopes of reducing property taxes. Luckily, his efforts were unsuccessful.

His opponents in the Republican primary are even more keen on raising sales taxes. Former State Sen. Don Huffines wants to abolish the property tax system entirely, but in order to offset this tax cut, an increase in the sales tax would be necessary. Former party chair Allen West also wants to abolish property taxes, and he openly admits that he would offset this by instituting a “consumption-based tax.”

Unfortunately, the Democratic candidates for governor have not offered any improvements in this area either. Former Rep. Beto O’Rourke, the Democratic frontrunner, has been conspicuously silent on the issue of tax reform, unless you count his proposal to tax churches that oppose same-sex marriage, a suggestion that is not only a political non-starter, but probably unconstitutional as well.

Since Texas’ leaders have been unwilling to take the initiative on fixing the state’s tax system, it is incumbent upon the citizens to bring the issue to the forefront and push their public servants to do something. As an election year in which Texas chooses its governor, the lieutenant governor and its entire legislature, 2022 presents an opportunity for citizens to pressure candidates for these positions to show what plans they have to alleviate the tax burden on low- and middle-income Texans.

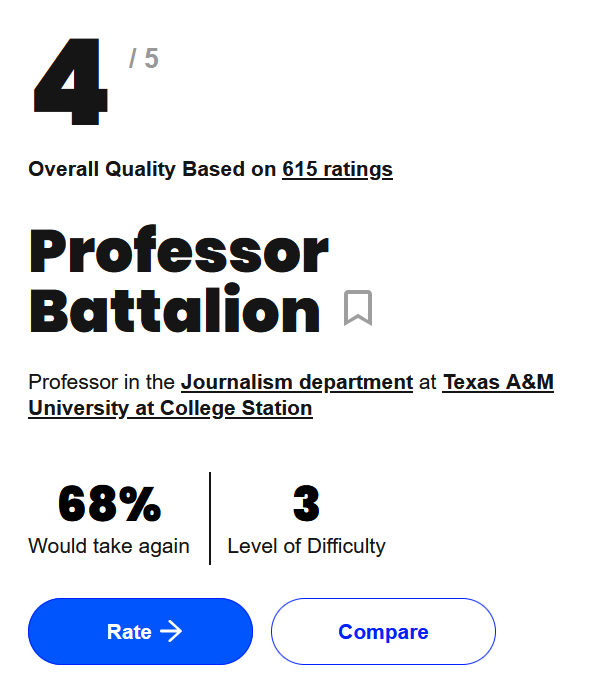

Alex Kourchev is an economics sophomore and an opinion writer for The Battalion.