Nearly $2 trillion.

As of 2022, $1.75 trillion is the amount of money that 45 million current and former students owe in both federal and private loans. Despite the importance of obtaining a college degree, the cost of higher education is now enough to financially devastate lower-income scholars. Student debt has increased exponentially over the past few decades — rising by 144% since 2007 — rapidly becoming an urgent crisis in America. Not only are these numbers alarming, but they also beg an important question: What is being done to help?

While loan relief efforts have been few and far between, the newfound urgency surrounding student debt has brought the issue to the forefront of our nation’s political agenda. In recent news, President Joe Biden released a student debt relief plan aimed to alleviate the burden of college costs on lower-income individuals through measures such as debt cancellation, cutting monthly repayments in half and improving current loan programs.

Furthermore, the Department of Education will improve upon the Public Service Loan Forgiveness Program, and make efforts to strengthen colleges’ accountability to ensure value returned for cost.

Though the initiative certainly seems to be a progressive step in the right direction, not all Americans agree. Biden’s plan has sparked great debate and controversy, with people raising concerns surrounding its fairness and impact on the economy.

Let’s begin with everyone’s least favorite topic: taxes. Biden’s loan forgiveness plan is a federal program, and thus will be mostly funded by taxpayer money. As a result, many critics fear their taxes will go towards funding upper-middle class students’ college tuitions. However, this couldn’t be farther from the truth.

According to the White House, the Department of Education estimates nearly 90% of relief dollars will go to individuals earning less than $75,000. No individual or household that qualifies as the top 5% of incomes in the United States will receive any relief.

Furthermore, the largest amount of debt cancellation possible, $20,000, will be reserved for Pell Grant recipients who hold federal loans. Just a reminder, Pell Grants are given to students who demonstrate exceptional financial need, majoritively coming from families who make less than $60,000 a year.

With these numbers in mind, it seems unlikely our hard-earned taxpayer dollars will finance some trust-fund baby’s journey to Wall Street.

Instead, Biden’s plan will give relief to the Americans who need it most: lower-income families and individuals who are struggling to make ends meet due to the skyrocketing prices of college attendance. Though 10% of relief dollars might go towards middle-income earners, it is completely unfair this percentage should overshadow the other 90% which will undoubtedly provide great aid to millions of lower-income students.

Nevertheless, I understand people don’t want to pay for someone else’s college expenses. But why does tax money always become a taboo subject when it’s time to fund education? Taxes are the means through which governments pay for literally every public service — from highway infrastructure to the military. No one bats an eye at these costs, so why should education be any different? If anything, investment in schools and learning should be a top priority.

Unfortunately, hypocritical politicians and news outlets intend on making the exact opposite seem true. Worthwhile federal expenditures are frequently distorted by political agendas and higher education often falls victim on this battleground of interests.

Another popular point of contention is costliness. According to The Committee for a Responsible Federal Budget, Biden’s student debt cancellation plan is estimated to cost anywhere from $440 billion to $600 billion over the next ten years. Worries surmount the possibility this expenditure will further increase the national debt, as well as negatively impact the economy.

Yes, nearly half a trillion dollars is a hefty sum. However, when compared to other government spending, it doesn’t seem so outrageous.

In 2021 alone, United States military spending surpassed the total amount Biden’s plan is forecasted to cost over the course of an entire decade — $754 billion, to be exact. In 2020, Medicare spending reached over $829 billion. These massive expenditures have yet to tank the economy and cause hyperinflation, so there is no reason loan forgiveness — which is a fraction of the size — should either.

The list of grievances goes on, but I won’t bore you with all my counterarguments. No, this plan will not solve expensive college tuition rates. Yes, $10,000 may just be a drop in the bucket for some student loan holders. But what’s the alternative, to simply not provide any aid at all? It’s impossible to create a solution that works for every single person in America.

To put it simply, Biden’s plan is progress. Progress in the right direction, something which this country has seen far too little of since the student debt crisis began to emerge back in the 1980s.

Personally, I’m already dreading the years of financial stress that will commence upon graduating. I am a sophomore undergraduate student who comes from a lower-middle class family, and I’ve already accumulated thousands in federal loan debt. My hard working parents have to put both my younger sister and I through college, so scholarships and financial aid have played a vital role in financing my college costs.

When I first learned about Biden’s student loan forgiveness plan, I felt a spark of hope. I’m eligible to receive up to $10,000 in relief, which could cover about half of the loans I’ll owe by graduation. This makes a world of difference.

For myself and millions of students in similar or worse circumstances, Biden’s plan promises some freedom. This impact is what everyone should keep in mind when critics try to rip loan forgiveness to shreds. Ultimately, financial struggles and economic debates have no place coming between a student and their degree.

Though politics, battling interests and close-mindedness all conflict over the impact and purpose of Biden’s initiative, the reality is this: it will help those in need.

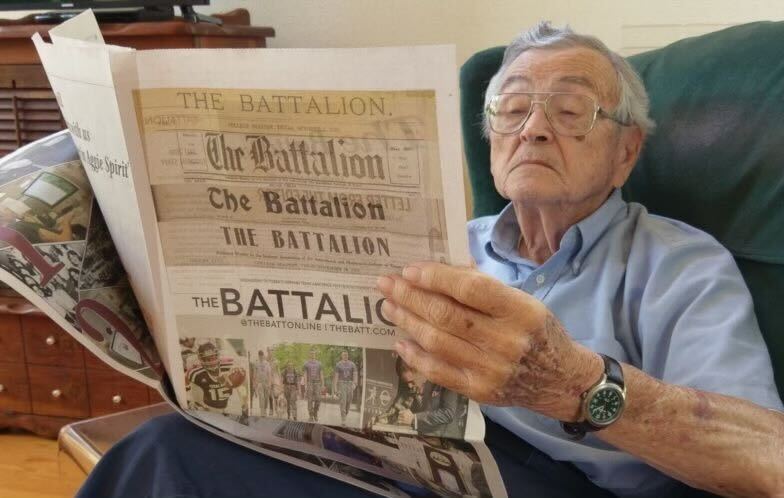

Ana Sofia Sloane is a political science sophomore and opinion writer for The Battalion.

Opinion: Hopelessly indebted

September 7, 2022

Photo by Photo courtesy of Jimmy Baikovicius

Opinion writer Ana Sofia Sloane argues for President Joe Biden’s loan forgiveness program.

Donate to The Battalion

Your donation will support the student journalists of Texas A&M University - College Station. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.